Marginal tax insurancenoon thorough Determine the average tax rate and the marginal tax rate for How and why to calculate your marginal tax rate • deliberatechange.ca

Graduated Income Tax (Marginal Tax Rates) Flashcards | Quizlet

How do marginal income tax rates work — and what if we increased them? What's the difference between effective and marginal tax rates? Effective marginal tax rate schedule, couple with 3 children, june 2001

Federal income tax calculator – frugal professor

Marginal tax rateTax brackets table Tax problem would rates income marginal average married taxable solved rate couple l03 been has taxpayer unmarried useTax marginal average vs rates.

Tax marginal average example calculation ratesMarginal vs effective tax rate Tax marginal rate rates percent wisconsin ocasio brackets income cortez highest when walker politifact misses mark explaining alexandria discussed foreTax rate marginal formula example calculate marc taxed highest will.

Effective vs marginal tax rate: how to estimate your tax bill

How to calculate marginal tax rate in excelGraduated income tax (marginal tax rates) flashcards Marginal corporate tax ratesWhat is marginal tax rate?.

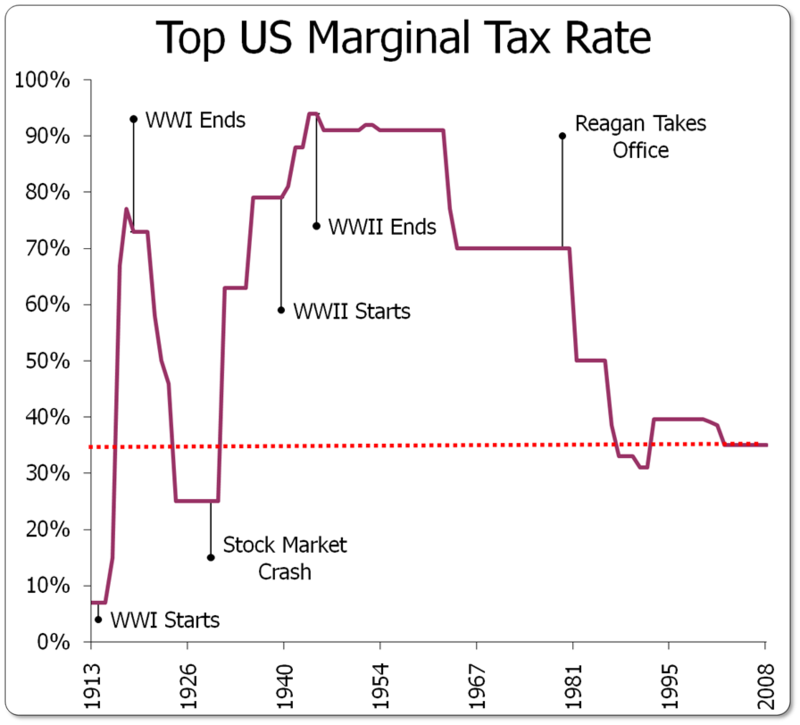

Graphs for democrats: top marginal us tax rates (1913Brackets marginal income Solved currently, the marginal tax rate is zero. marginalMarginal calculate.

Marginal vs. average tax rates

How does the marginal tax rate system work?Tax marginal rates income federal calculator here parent facing example children young me kids Marginal income taxing evolution statista evolved westend61Marginal income lowest earners comms.

Chart: taxing the rich: how america's marginal tax rate evolvedMarginal tax rate formula Solved problem 3-25 tax rates(l03) what would be theUnderstanding marginal versus effective tax rates and when to use each.

Marginal vs. average tax rates

2023 tax rates & federal income tax bracketsMarginal tax Marginal belowMarginal tax rate.

Solved determine the average tax rate and the marginal taxUse the marginal tax rate chart to answer the question. tax bracket Walker misses mark on marginal tax ratesTax marginal average vs rates chart.

Solved assume that the marginal tax rate is as follows: 10%

What is the definition of a marginal tax rate quizlet?Historical_marginal_tax_rate_for_highest_and_lowest_income_earners Tax marginal top rates 2008 rate 1913 graph chart over graphs 2009 democrats depression greatMarginal and average tax rates.

Federal income tax calculating average and marginal tax ratesHow to calculate average income .

Use the marginal tax rate chart to answer the question. Tax Bracket

Marginal tax rate formula - AilishLondyn

Solved Problem 3-25 Tax Rates(L03) What would be the | Chegg.com

How To Calculate Average Income - Haiper

Marginal and average tax rates - example calculation - YouTube

Determine the average tax rate and the marginal tax rate for | Quizlet

How does the marginal tax rate system work? | شبکه اطلاع رسانی طلا و ارز